Happy New Year, and welcome to the 78th installment of Pitch Deck Teardown!

This week, we are taking a closer look at Pepper Bio‘s seed pitch deck that landed the company $6.5 million. With the slogan “The end of untreatable,” the company is taking on a hell of a challenge: Finding solutions for all those illnesses doctors can’t target well at the moment. Unlike CancerVax (which I ripped apart in a previous teardown for being completely unbelievable), Pepper Bio has a strong team and a lot of promise.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Before we dive in, I have to admit that I don’t deeply understand this particular slice of biotech, and I had to do a fair amount of Googling to fully understand the deck. As such, there’s a chance I may get some things wrong here. That also speaks to an important point, though: Your deck needs to be well-targeted to its audience, and I’m probably not the audience in this case. If I had been working with Pepper as one of my pitch coaching clients, I’d have encouraged them to make the story come to life a lot more, with examples and anecdotes that are more relatable for a general population. Having said that, the simple truth is that I’m notthe target audience for this deck: biotech investors are.

Give Anna’s story from November a read for some context, and then we’ll get to the pitch deck itself:

Drug discovery startup Pepper Bio hopes to challenge Eroom’s law with new funding

Slides in this deck

- Cover slide

- Problem slide 1

- Personal story slide

- Team slide

- Problem slide 2

- Solution slide 1

- Results slide

- Solution slide 2

- Solution slide 3

- Application slide

- Target market slide

- Business model slide

- Go-to-market/beachhead slide

- Timeline slide

- Traction/revenue slide 1

- Traction/revenue slide 2

- Revenue projection slide

- Technology evolution slide

- Future vision slide

- Closing slide

Three things to love

The thing that confuses me the most about this pitch deck is that someof the slides are incredibly accessible, while others are . . . Well, we’ll get to that in just a moment.

A personal story

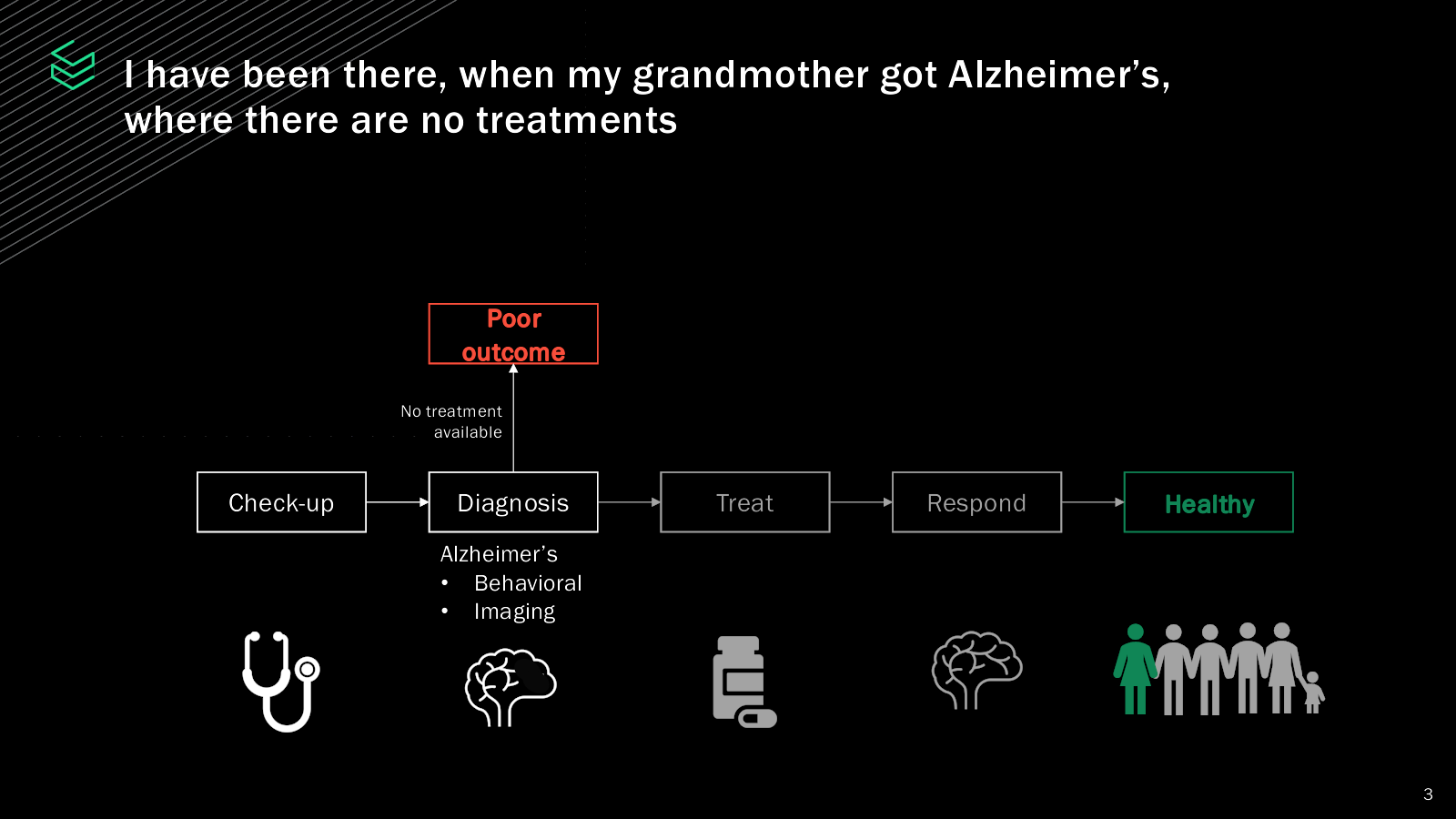

I love a good personal story. Tying yourself to the problem you are trying to solve helps a story come to life; it prevents a narrative from getting abstract or obtuse and enables you to speak from the heart. In this case, the CEO tells the story of their grandmother, and how the absence of treatments for Alzheimer’s was a sad outcome.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWObviously, I haven’t heard the voice-over to this slide, but I think there are many ways it could be improved (a photo of the grandmother in question, perhaps?). Still, this is a good first step.

ELI5

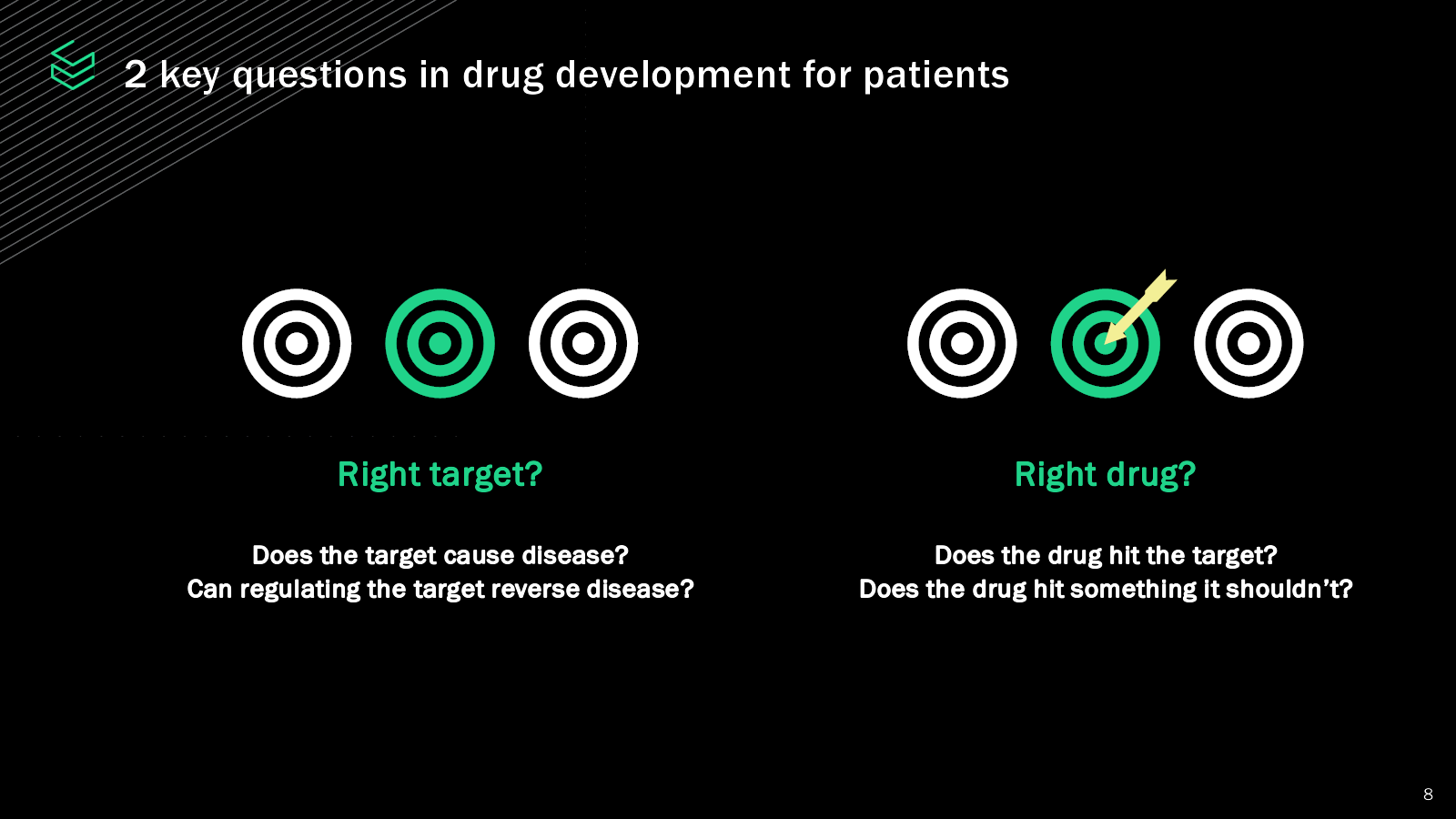

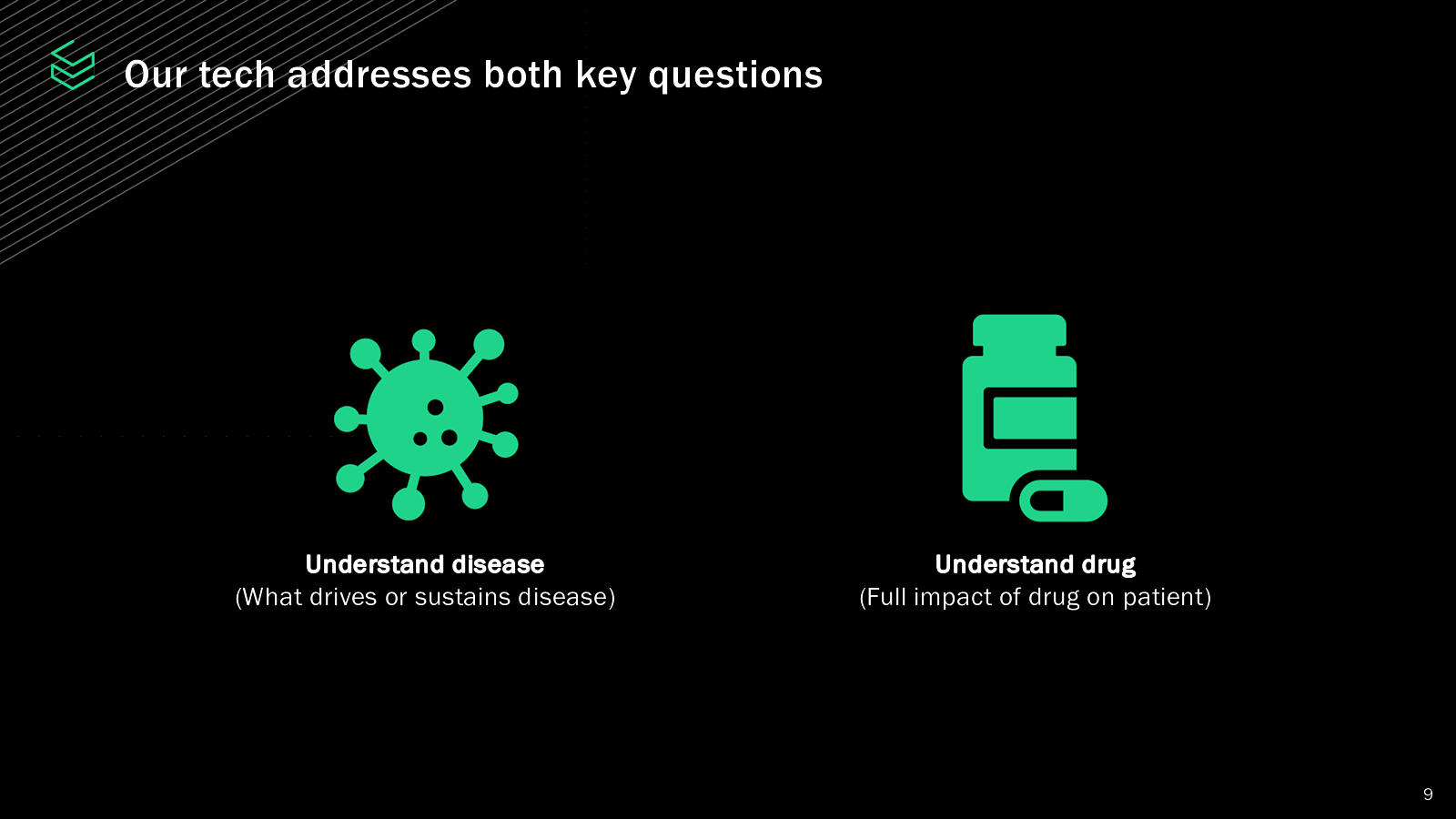

There’s a subreddit called Explain Like I’m 5 where people attempt to explain complex topics as if the reader were a five-year-old. Pepper Bio lost me a bunch of times in this deck, but then hits us with this incredible duo of slides:

This slide is a masterpiece. It explores the problem space the company is trying to address in incredibly simple words.

And then comes the mic drop:

I love this pair of slides for their simplicity and power. They nail the narrative and help set the scene beautifully for what is to come. In a world that’s often laden with deeply technical language, Pepper Bio sets itself apart for a moment.

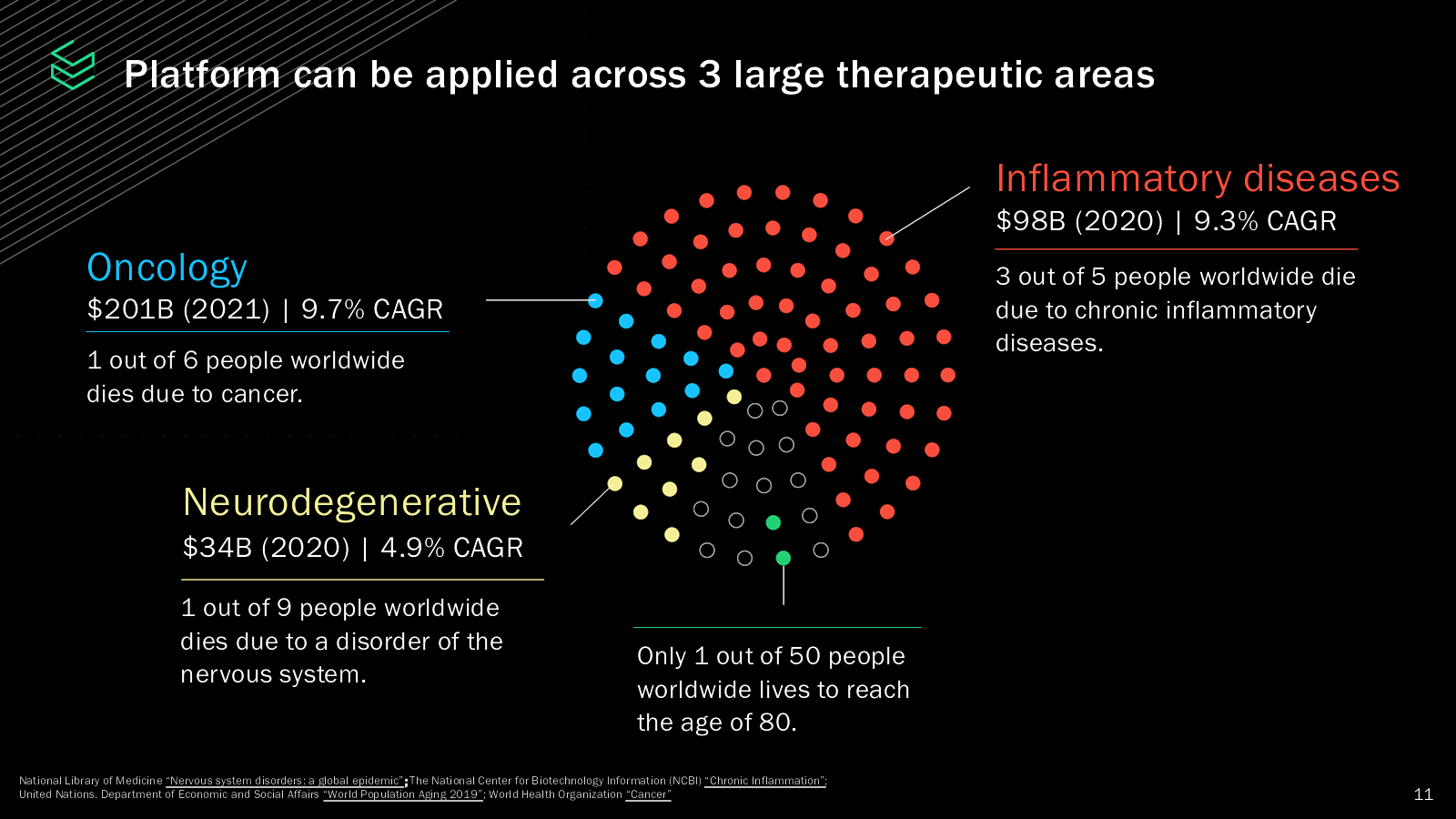

The mother of all market sizes

This slide is, both in terms of the visuals and content, a masterpiece. It identifies three significant therapeutic areas with substantial market opportunities: oncology, neurodegenerative diseases, and inflammatory diseases. The financial figures provided are pretty impressive, indicating robust compound annual growth rates for each category.

The startup’s identification of oncology as a market with a value of $201 billion in 2021 and a CAGR (compound annual growth rate) of 9.7% is particularly notable. This suggests a deep understanding of a sector that is both in critical need of innovation and holds significant financial promise. The stark statistic that one out of six people worldwide dies from cancer underscores the profound impact that advancements in this area could have.

It then goes on to repeat similar numbers for neurodegenerative diseases and inflammatory diseases, each with huge market sizes and promising growth rates.

Overall, the slide does an excellent job of highlighting Pepper Bio’s potential reach and impact in areas that are not only financially vast, but also of critical importance to global health. A hell of a combo.

Now, of course, the company doesneed to show that it isn’t spreading itself too thin and that it makes sense to operate in all of those market segments. But that’s a nitpick: Overall, this is one of the better market size slides I’ve ever seen.

In the rest of this teardown, we’ll look at three things Pepper Bio could have improved or done differently, along with its full pitch deck!

Three things that could be improved

There are a lot of things to love here, but we have some serious flops, too:

That’s not how traction works

On three whole slides (slides 15 through 17), the company says it is generating revenue but then doesn’t explain how much. Each of these slides includes ranges and suggestions, which frustrates me and makes me suspicious. If you say you’re generating income, then it’s probably easy to show how much money has flowed into the bank account. It’s rather strange to leave that crucial bit out.

It would have been far better to show this as a chart or graph to give some idea how much revenue has been booked.

English, please

I’ve read this slide a half dozen times and I cannot wrap my head around what it is saying:

I don’t know what “HCC” is — it isn’t defined in the deck. It could be hepatocellular carcinoma (HCC), which, per the Mayo Clinic, is the most common type of primary liver cancer. But it could also be something else. There’s plenty of space on this slide to spell it out.

Also, I am curious about the sample size here. How many animals were tested? What type of animals?

I’m not sure what “vehicle control” means, either. What is a “vehicle” in this context? Is that a technical term? Could it just say “control group”?

Does “standard of care” refer to the regular treatments currently used for this type of tumor? If so, what is that treatment?

What does “Pepper Bio target” mean in this context? The cells the company is targeting?

I’m having to do a lot of guesswork here, and I’m left confused. The company talks about animals and “the clinic,” but I’m not sure if this means that it plans to continue to treat animals for this illness, or whether that means it is planning to start treating humans? Wouldn’t there be some sort of FDA approval process?

All in all, this slide is a huge piece of confusion sandwiched between needlessly technical language, in my opinion.

No ask or use of funds

The company raised $6.5 million, but the slides never explain what the company is planning to accomplish with the money. The deck is pretty hand-wavey about grand visions for the future, and I have no doubt that Pepper Bio, if it delivers on its promises, can continue to raise money and be successful.

But as an investor, you’re trying to gauge what the next step of the journey is going to be, and whether that will generate enough traction to get the company to a good place. That’s completely unclear here, which makes it very hard to determine whether $6.5 million is a reasonable amount to raise and whether the company is on the right track.

The one slide 95% of founders get wrong when fundraising

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!