Yesterday this column discussed a tranche of data from Carta detailing an evolving venture capital market. We argued that the collected information showed the existence of a Series C “crunch,” or a bottleneck in the capital ladder that startups climb.

Because there have been “crunches” at various stages before, the fact that Series Cs are particularly stubborn today might not ruffle your feathers. But because C rounds could be considered the gateway to late-stage startup status, many upstart tech companies are staring down a widening chasm from their Series A and B rounds and their hoped-for future.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

There’s good news and bad news for early-stage tech companies.

GGV’s Jeff Richards, a venture capitalist with a penchant for tweeting investment banking research (which never bothers us), noted on Twitter in response to our reporting that while Series C and D rounds do look pretty nasty today, there’s reason to believe that a good number of early late-stage companies are going to have enough cash to self-power for some quarters to come:

Helpful data, 🙏 @alex. Series C down 80% in $ raised, Series D down 74%. Related: a lot of companies at this stage still have 18+ mos of cash runway from large raises in '21. https://t.co/KOaZriVHIk

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOW— Jeff Richards (@jrichlive) November 21, 2022

This raises the question of what time— the 18 months or more of cash runway that these companies have — will buy the startups in question. Certainly, it will grant them time to grow, expanding their revenues and market footprint. Both may help them raise at an attractive price when their cash does, finally, run low.

But will valuations recover in the interim? Will the overall climate for software company valuations rebound in time for the above companies to not only leverage growth, but will there also be investors willing to pay more per dollar of software revenue when they do raise again? Here, opinions diverge.

I asked GGV’s Richards if valuations will have recovered by the time the over-funded late-stage startups in question attempt to raise. He took exception with my implied point that valuations are lower than is reasonable, writing that “we are just slightly below ‘normal,’ for what it is worth.”

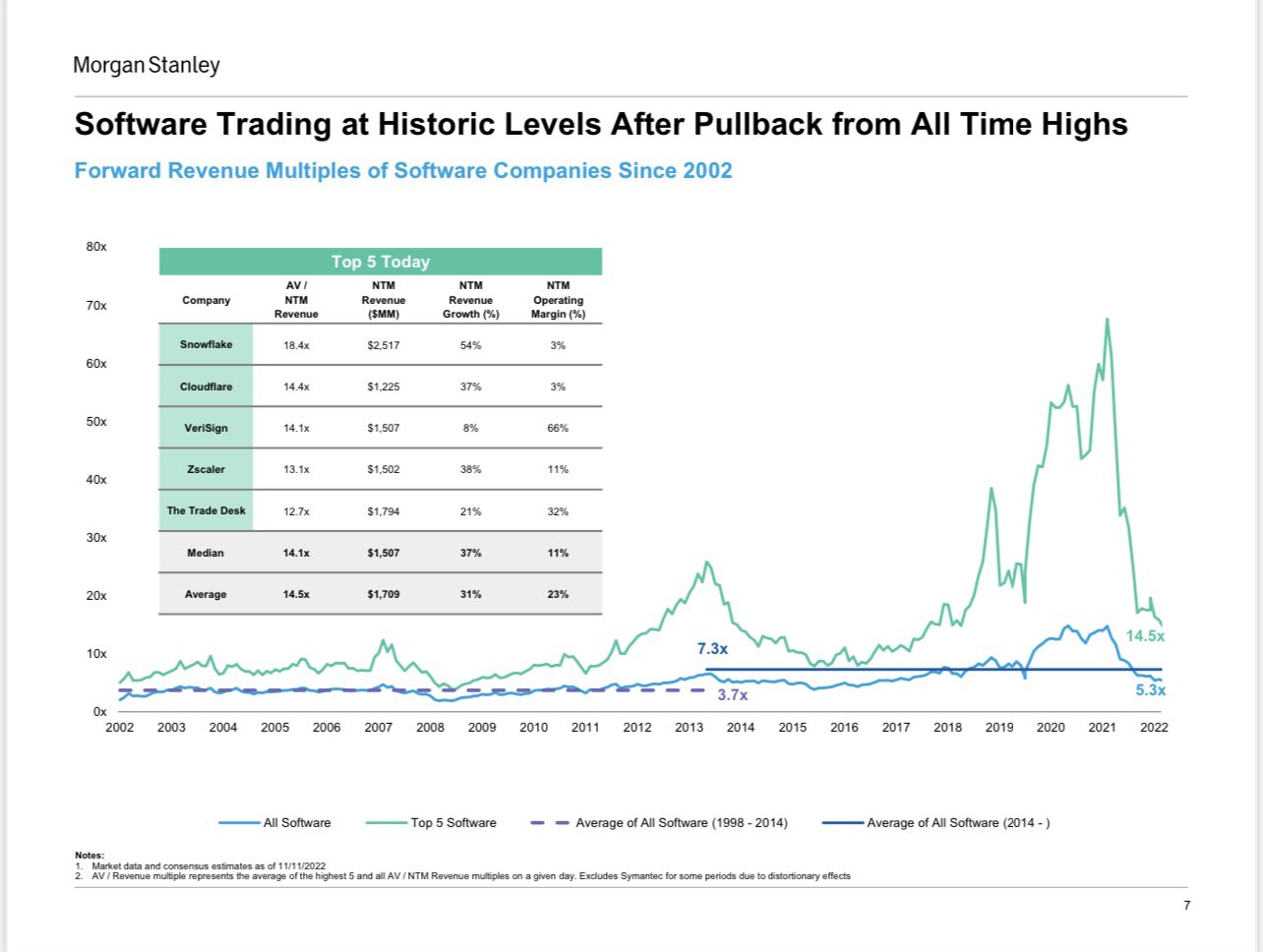

To make his point, Richards shared the following chart:

Let me help: Ignore everything but the following numbers: 3.7x, 7.3x, 5.3x. Those numbers are, in order, revenue multiples for software companies from 1998 to 2014, 2014 to this November and the present figure.

The data indicate that while valuations from 2014 on — loosely, the unicorn era — were elevated compared to historical norms, even after recent declines, today’s valuation marks for software companies are still above what was considered normal prior to 2014.

However, SaaS-focused venture capitalist Jason Lemkin weighed into the conversation with a positive take:

Valuations should rebound 25%-40% once we are past the Inflation Peak and interest rates decline a bit

Too conservative to bet otherwise

No reason to believe they will ever reflate to 2021 levels in our investing lifetimes

— Jason ✨🇬🇧SaaStr LDN June 4-5✨ Lemkin (@jasonlk) November 21, 2022

A 25% rebound on a 5.3x average multiple would work out to 6.6x, while a 40% bump would bring us to 7.4x, or loosely back to the average since 2014. Note that the 2014-2022 average — 7.3x, per the above chart — is far lower than what we saw in 2021. Last year’s excesses actually skewed the figure higher.

Regardless, is Richards’ slightly more conservative take or Lemkin’s perspective more correct? It’s actually somewhat easy to support either:

- The Valuations Aren’t Going To Rebound Much perspectiveis undergirded by the fact that we appear set to live and work in a far stricter interest rate environment for the foreseeable future. This implies that money will stay expensive, alternative investments will remain attractive, and tech valuations will continue to be depressed compared to what we became accustomed to during the unicorn era. Also, Union Square Ventures’ Fred Wilson argued back in 2011 that 3x to 4x SaaS multiples made sense, meaning that we’re still above what was a decade ago considered fair. Why would we expect to do better today?

- The Valuations Are Going To Recover argumentis supported by the fact that software companies have grown faster for longer than was previously anticipated. As we learned during the pandemic, tech companies can prove somewhatcontra-cyclical during economic downturns; they may be able to defend an anti-risk premium. More simply, all the arguments that last year were used to defend insane software valuations may in fact be reasonable at lower multiples, multiples that are a bit richer than what the market is currently affording tech companies both big and small.

Pick your poison, but note that it is hard if not impossible to find an investor willing to defend what happened back in 2021. The question, instead, is this: How small of a discount to 2021’s valuation climate are you willing to argue the tech market should endure moving forward? Or put another way, how conservative are today’s valuations when compared to the norms of recent years?

I think I hazard a bit more Richards than Lemkin but would love to be proven wrong, if for no reason other than the fact that my personal index fund is replete with tech holdings and I would like to retire someday.

Time will tell, but that’s the current argument when it comes to tech valuations. Give thanks this week that Fred Wilson’s old blog post is still looking too conservative in the modern moment. Things could be worse.