VCs often use the shorthand phrase “two and twenty” to refer to the 2% of annual management fees a venture fund might take and the 20% carried interest (or “performance fee”) it would charge. In a nutshell: If a venture fund turns a $100 million profit from its investments, the fund gets to keep $20 million of that, and the remaining $80 million is paid out to the limited partners.

The “2 and 20” fee structure was originally associated with hedge funds, but VC firms and other investment funds use it as well. The structure breaks down into two types of fees: a management fee and a performance fee.

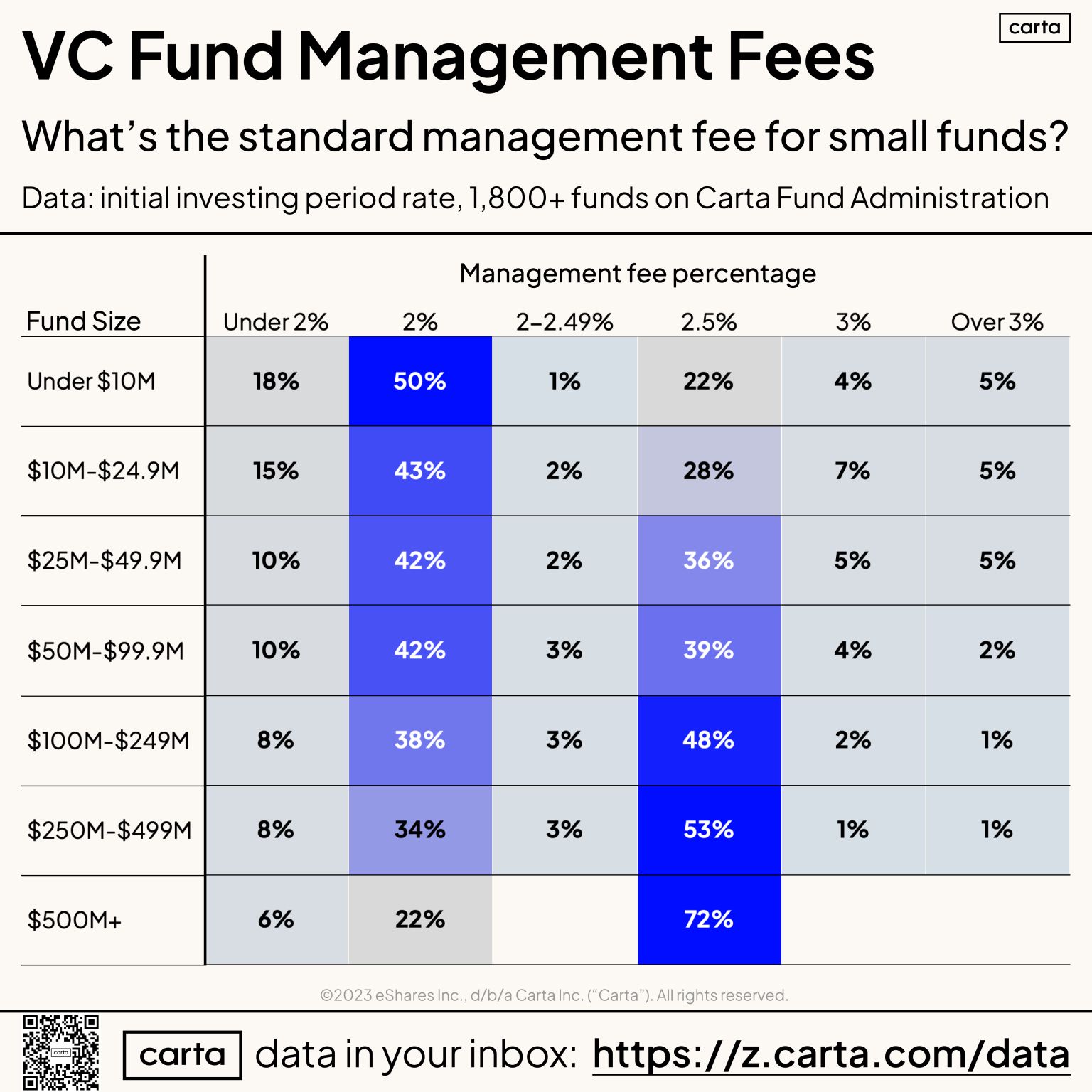

The management fee is a yearly charge calculated based on the total assets under management (AUM). Typically, the management fee is 2% of AUM, but new data from Carta shows that the 2% figure isn’t as universal as you might have been led to believe.

First, it’s useful to understand what the management fee is for. Basically, it compensates the fund managers, regardless of the fund’s performance. So a VC firm that charges a 2% fee for managing a $100 million fund will receive $2 million per year to cover rent, staff costs, marketing, travel and, well, everything else.

The other part of the compensation is the carried interest — the portion of the profits that the VC firm takes once investments start paying off. Most commonly, this is set at 20% of the fund’s profits, with the idea being it works as an incentive to encourage the VC firm to maximize returns. Yes, just getting paid the management fee can be lucrative, but the get-rich-slow scheme for venture capitalists is the carry, as their compensation increases when the fund performs better. There are also variations to these fee structures — for instance, performance fees might only apply once a certain hurdle rate or minimum return is achieved.

So while 2 and 20 is a pretty common shorthand, I was intrigued to learn from Carta’s head of insights, Peter Walker, that the numbers are actually not as set-in-steel as we think.

Two percent appears to be the most common fee rate, especially for funds with less than $100 million in AUM. Above that, though, the rate climbs to a median of around 2.5%. More than 50% of small funds that manage $10 million or less enjoy a 2% management fee, but nearly three-fourths of the funds that manage $500 million or more are able to claim 2.5% management fees, per Carta data.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOW

Obviously, larger funds also have more administration to do, but given that they start from a higher base to begin with, it means they collect at least $12 million per year.

It’s worth noting that the data is for the initial period of each fund, which is usually the first two years of a fund’s investment period. Some funds are structured so that the management fees drop gradually after the initial investment period.