A robotic taxi drove me home a few nights ago, and it was just fine.

As it carried me through Golden Gate Park at a steady 23 miles per hour (slowing down to 6 mph for every speed bump), I felt like a packet of information being delivered across a network.

Since our last robotics investor survey in February 2020, Figure emerged from stealth with its bipedal humanoid robot, and Boston Dynamics’ Atlas became a parkour expert.

Autonomous tractors, semi trucks and warehouse restocking bots have gone from concept to reality. Is robotics mainstream now?

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUPto save 20% off a one- or two-year subscription

“The time in between has arguably been the most important years for the sector,” writes hardware editor Brian Heater, who asked 13 investors about several topics, including robotics as a service, emerging consumer products, and how much of a role it might play in addressing climate change:

- Milo Werner, general partner, The Engine

- Abe Murray, managing partner, Alley Robotics Ventures

- Kelly Chen, partner, DCVC

- Neel Mehta, venture investor, G2 Ventures

- Oliver Keown, managing director, Intuitive Ventures

- Rohit Sharma, partner, True Ventures

- Helen Greiner, advisor, Cybernetix Ventures

- Kira Noodleman, partner, Bee Ventures

- Dayna Grayson, co-founder and general partner, Construct Capital

- Paul Willard, partner, Grep

- Cyril Ebersweiler, general partner, SOSV

- Claire Delaunay, private investor

- Peter Barrett, co-founder and general partner, Playground Global

Thanks very much for reading TC+ this week!

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWWalter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

13 VCs talk about the state of robotics investing in 2023

Vote for TechCrunch in the Webby Awards!

Two TechCrunch podcasts, Chain Reaction and Found, have each been nominated for Webby Awards in the Best Technology Podcast category.

Cast your vote before Thursday, April 20!

4 SaaS engagement metrics that attract investors

Past performance doesn’t always predict future results, but it’s the best place to find customer retention stats that have investor appeal.

According to Oleksandr Yaroshenko, head of investments and strategy at edtech startup Headway, engagement rates for existing customers are “the best predictors for resubscription.”

In this post, he explores gamification strategy and shares ideas for building a “golden cohort” that represents your target audience.

4 SaaS engagement metrics that attract investors

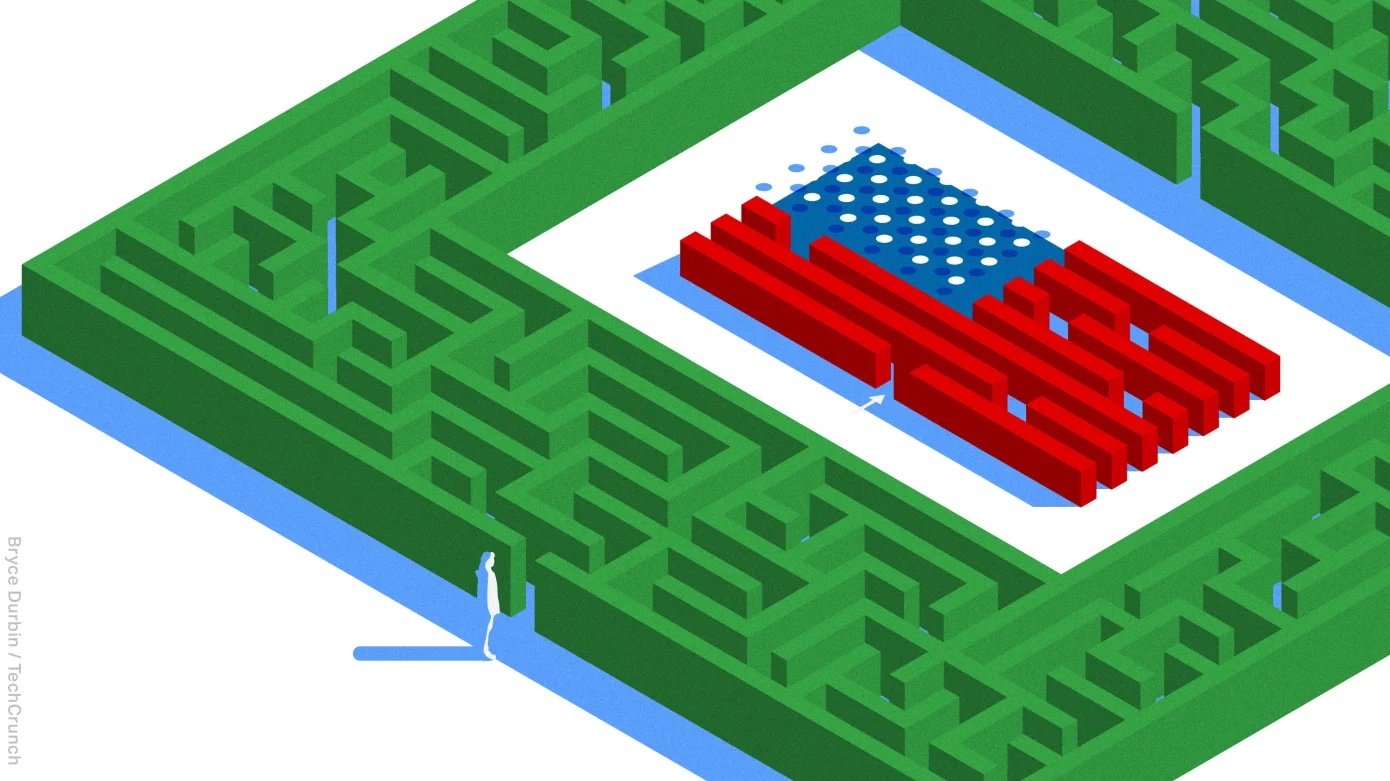

Ask Sophie: How many employment green cards are available each year?

Dear Sophie,

I’m trying to figure out how long I have to wait for a green card.

I have two questions for you: How many employment green cards in each category are available every year? How do I make sense of the Visa Bulletin?

— Standing By in San Jose

Ask Sophie: How many employment green cards are available each year?

Secondary market trackers are lighting up a traditionally dark deal environment

Startup valuations are down, but by how much?

Instead of waiting for founders to launch their next fundraising rounds, savvy players are watching the secondary markets, “where investors can buy and sell existing stakes in a startup or fund,” reports Rebecca Szkutak.

“These deals were traditionally harder to track than primary venture capital deals, as they don’t generally get announced, but a new fleet of startups is shining light on them,” such as Caplight, Notice, Birel and Hive Markets.

“I was so appalled at how fragmented and busted the data was, even as a broker who was active every day,” said Notice founder Tyson Hendricksen. “It was really hard to figure out what was going on.”

Secondary market trackers are lighting up a traditionally dark deal environment

VCs still think work software is a wise investment

As employers and workers come to grips with the new reality of remote and hybrid offices, investors are continuing to fund startups that produce work software, according to a Deloitte report released this week.

Kyle Wiggers says several trends are driving VC interest in the future of work: In a down market, investors are looking for sustainable growth, “which tend[s] to be found among longer-lasting, ironclad business-to-business contracts for software tool suites.”

VCs still think work software is a wise investment

MassMutual launches $100 million fund to invest in diverse founders

Two years after launching its first $50 million MM Catalyst Fund to support diverse founders, insurance company MassMutual is doubling down.

Dominic-Madori Davis interviewed Liz Roberts, the company’s head of impact investments, to learn more about their new $100 million impact fund and discuss how past monies have been allocated.

“We would like to have more peers investing alongside us with this sort of thesis and understanding,” said Roberts. “We’re very small in a large opportunity.”

MassMutual launches $100M fund to invest in diverse founders

Pitch Deck Teardown: Diamond Standard’s $30M Series A deck

Diamond Standard landed a $30 million Series A for its blockchain-based investment platform last year and shared its 11-slide deck with TechCrunch+:

- Cover and mission slide

- Summary slide

- Solution slide (“Introducing the smart commodity”)

- Problem slide (“Diamonds are severely underallocated”)

- Market Opportunity (marked as slide 4 on the deck)

- Roadmap slide (“How do we make a diamond commodity,” marked as slide 5 on the deck)

- Product slide 1 (“Diamond Standard Exchange”)

- Product slide 2 (“Diamond Standard Recycling”)

- ESG slide (“Diamonds are a powerful ESG investment”)

- Founder slide

- Organization slide

Pitch Deck Teardown: Diamond Standard’s $30M Series A deck

CeFi and DeFi in the face of regulation

Will the FTX debacle trigger a regulatory clampdown across crypto?

“Most expect the worst,” says Ira Lam, chief legal officer at SuperLayer. “A reactive blanket crackdown on all aspects of crypto, framed as necessary to protect the public from future bad actors, seems imminent.”

In this detailed market analysis, Lam studies the differences between decentralized and centralized finance systems with an eye on the different ways risk manifests in each environment.

“While it may be a long time until we see significant movement toward consumer protections in crypto, one thing is certain: CeFi and DeFi cannot exist without each other.”

CeFi and DeFi in the face of regulation