When talking to investors, you’re answering the what (product), why (mission), where (if relevant) and how (strategy and go-to-market). But founders often ignore another important question: Why now?

Why wouldn’t it have been possible to have built the company five years ago? Why would five years from now be too late? The answer is often related to something that is shifting and changing, either in the market or with the technology layer. Anchoring your company with a good “why now?” slide is a great addition to your story.

Successful companies usually have these things in common: They were the right company, solving the right problem at the right time. Think of all the startups that cropped up during the early years of the pandemic that were solving specific problems related to accessing health care or presenting meetings.

Showing that you know why you’re launching now as opposed to any other time will create a sense of urgency: Investors won’t want to miss out on a business that’s solving what they see as an immediate problem. It’s your job to highlight the ways your company can address those issues and why now is the right time to do so.

It’s often possible to see some significant market trends converging, but when it comes to timing, you’re basically trying to read the future. In the words of Wayne Gretzky, you want to be skating to where the puck will be, not where the puck is. The “why now?” question can be answered in a number of ways, but it usually boils down to at least one of these three things: technology timing, market timing or regulatory timing.

Think about consumer-grade photography drones. Why did they arrive on the scene when they did? After all, RC planes and helicopters have been around since the 1970s. Compact video cameras (such as GoPros) have been around since the early 2000s. It’s not that the tech didn’t exist; it’s that the technology required was prohibitively expensive for a consumer-grade piece of equipment.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWThe fundraising stages are not about dollar values — they’re about risk

Apple’s iPhone changed that, though. As smartphones became ubiquitous, small camera modules, solid-state accelerometers, radio and GPS chipsets all became dirt cheap, available to hobbyists, and both well documented and hackable. Once the tech got small and cheap enough, building camera-equipped drones was a logical next step.

The most successful startups of our era did three things: They spotted a trend early and developed a solution to take advantage of that. Google, Facebook and Apple are all good examples here: They weren’t the first search engine, social network or smartphone/computer manufacturers, but they saw an opportunity to make the tech more user-friendly. They were able to build solutions that were better than anything else out there. Then they ended up defining the industries they entered, riding the wave to the top.

Data says there are only two seasons for fundraising and one secret window

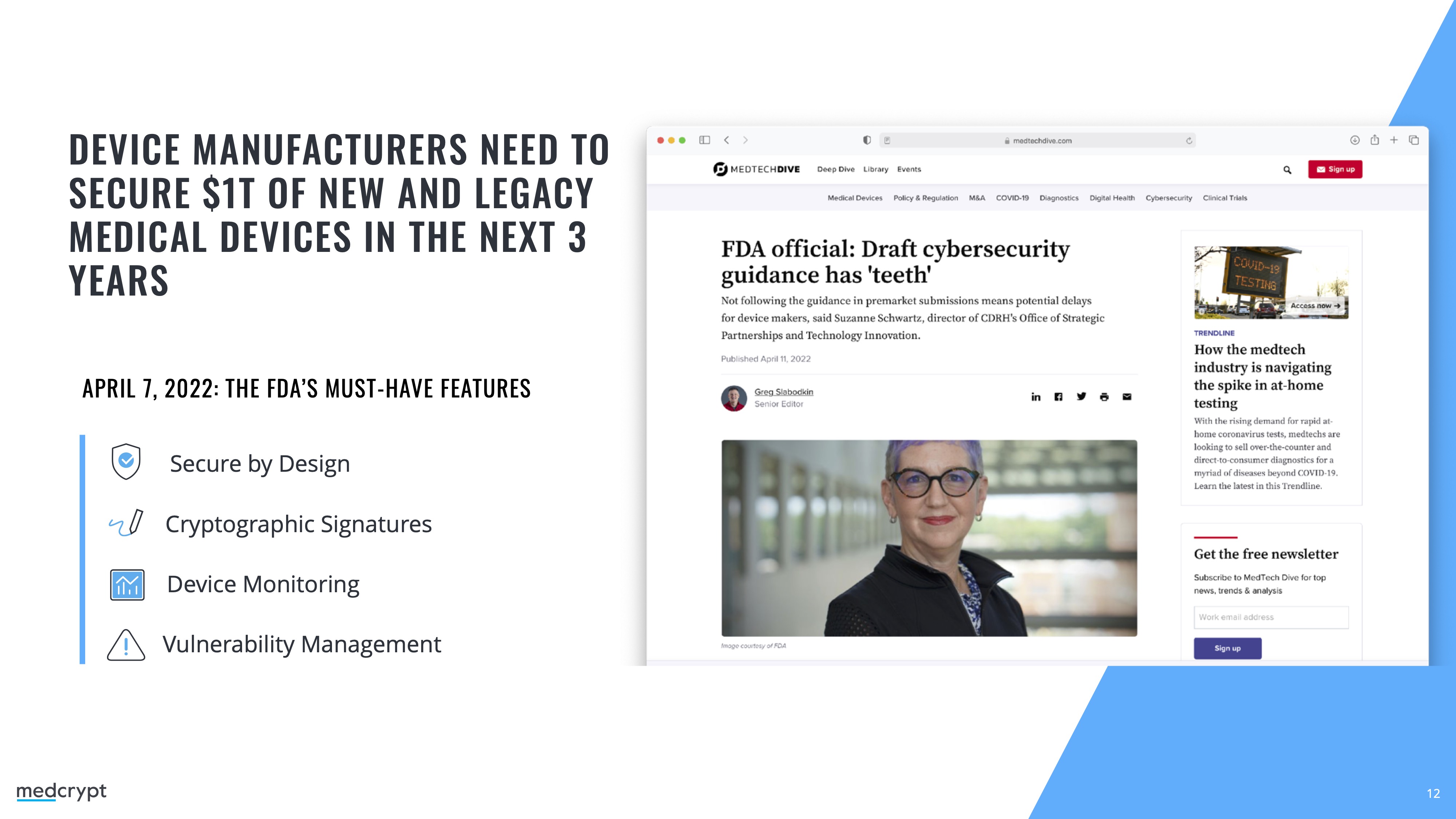

Regulatory shifts can be a powerful market driver, too. In MedCrypt’s deck (see the Pitch Deck Teardown of its $25 million Series B fundraising deck), the company explains a shift in data safety requirements from the U.S. Food and Drug Administration that make the company perfectly positioned to solve that problem for the millions of medical devices that are already out there.

You can use your timing narrative to reiterate some of the biggest strengths of your startup. You should explain the macro dynamics of your space, how the market is evolving and how new technological innovations make your company possible when it wouldn’t have been before.

Remind the investors how changes in regulatory frameworks are opening new opportunities. That includes demographic shifts (the population as a whole is aging); technology shifts (self-driving cars, solar power, electric vehicles, 5G mobile phone networks); market shifts (homeownership numbers, market boom/bust times); significant changes in how work is done (the gig economy, working from home, remote-first companies). Many of these trends are somewhat predictable, and the best startup founders know how to spot them and leverage them to their advantage.

It’s an opportunity to remind investors how your team has been in this industry for a long time. Something like, “I saw all of these shifts happen when I was a VP of investment banking at Goldman Sachs for 15 years,” is a great way to remind the investors that you have both experience and in-depth domain knowledge.

The “why now?” is partially about history, but remember that it’s not a history lesson; it’s about trends. You can use past data and innovation to draw a trend line toward the future. Combine that with what your company is doing and where it is going. The perfect “why now” slide has a fast-moving puck and a startup moving at breakneck speed to intercept it where it’s going to be in five years.

This is the sort of thing that makes investors salivate; the world’s most significant opportunities are high-risk, high-reward movements. Think big and weave a story of how you are on the right vector to be in the right place at the right time.