Hyperexponential, a London-based insurance technology (insurtech) startup that serves the property-casualty (P&C) insurance industry with “decision intelligence” for pricing, has raised $73 million in a Series B equity round of funding.

Boston-based venture capital firm Battery Ventures led the round, with participation from existing investor Highland Europe and Andreessen Horowitz (a16z).

Founded in 2017, Hyperexponential helps insurers and reinsurers make better-informed pricing decisions using predictive data and insights gleaned from a broader array of sources — including where this data might be niche, sparse and hugely fragmented.

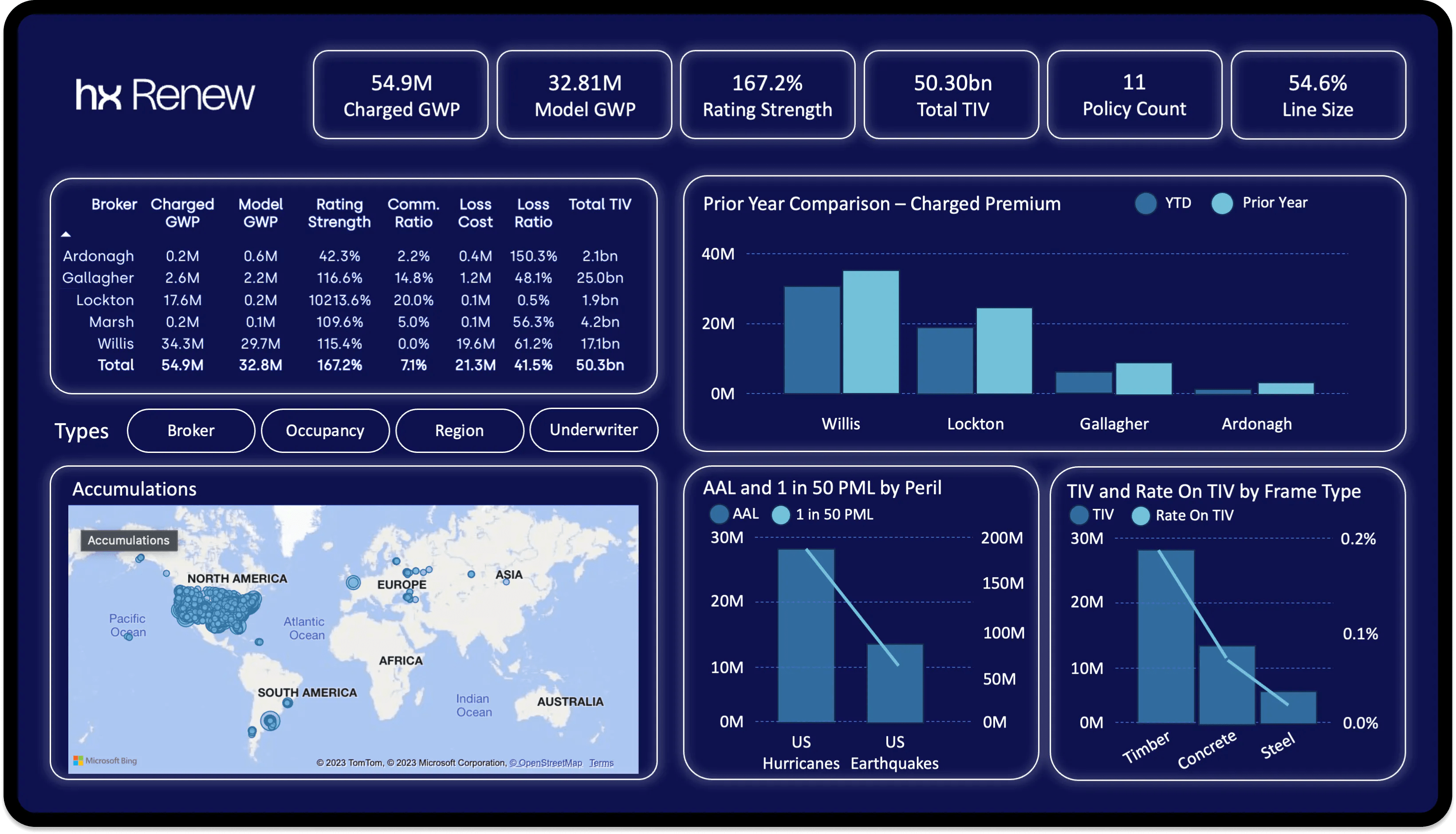

With Hypereponential’s HX Renew software, insurers can build predictive models and access APIs to integrate data sources and workflows between systems, with automation and machine learning helping asses risk and draw insights from data that is constantly changing.

Prior to now, Hyperexponential had raised an $18 million round of funding in 2021, and in the intervening years the company says it has grown sales ten-fold while remaining profitable — and it claims big-name clients such as insurance giant Aviva.

And this latest investment does tend to support these claims. A $73 million equity-based funding round stands out like a sore thumb in the current economic climate, suggesting that the target startup would have an attractive balance sheet and solid growth trajectory to warrant such a cash injection.

Moreover, that Hyperexponential is bringing in high-profile U.S. VC firms points to an international roadmap, with the company confirming plans to expand beyond its current operations in the U.K. and Poland to the lucrative U.S. market.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOW“We’ve focused on building a capital-efficient, independent business that was both high-growth and sustainable from the outset,” said Hyperexponential co-founder and CEO Amrit Santhirasenan, in a statement. “Although we have more cash-on-hand than we’ve raised, we wanted to bring on new expertise in our target markets as we continue our growth into new verticals and geographies.”

Europe’s calling

With both OMERS and Coatue exiting the U.K. VC realm in recent months, this had raised some questions about the appeal of Europe for earlier-stage investors. However, two far more established VC firms have actually done the opposite by turning to London for their first international hubs last year — one of those was IVP, and the other was Andreessen Horowitz, which opened its U.K. office in November.

Crypto, blockchain and associated “web3” technologies were among a16z’s core focus — a sector that the esteemed VC firm has been more than a little bullish about in recent years. And to be fair, it has continued to invest in crypto startups, including London-based Pimlico a couple of months back, but it has also been directing larger investments at the likes of AI, healthcare and enterprise — as evidenced by recent investments into Databricks and MotherDuck.

So while it would be false to say that crypto has fallen off a16z’s radar, it’s evidently keen to target bigger investments at tried-and-tested technology that is solving real industry problems today — the P&C insurance market was pegged as a $1.8 trillion industry last year, and coupled with Hyperexponential’s growth and profitability claims, it’s easy to see why this might appeal to any venture capital firm.

With another $73 million in the bank from two of the biggest VC firms in the U.S., Hyperexponential is well resourced to begin its global expansion this year, with plans to open a New York office and double its headcount to more than 200. The company also said that it plans to expand into adjacent markets, including SME insurance.