Syscap closed on $2.3 million in seed funding to continue building an infrastructure that helps Mexico’s non-banking lenders to manage and access private credit.

David Noel Ramírez and Alejandro O’Farrill met while working at the multinational beverage and retail company Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA). Both went on to do other things — Ramírez co-founded Concéntrico, while O’Farrill worked at Amazon and Nubank — prior to founding Syscap.

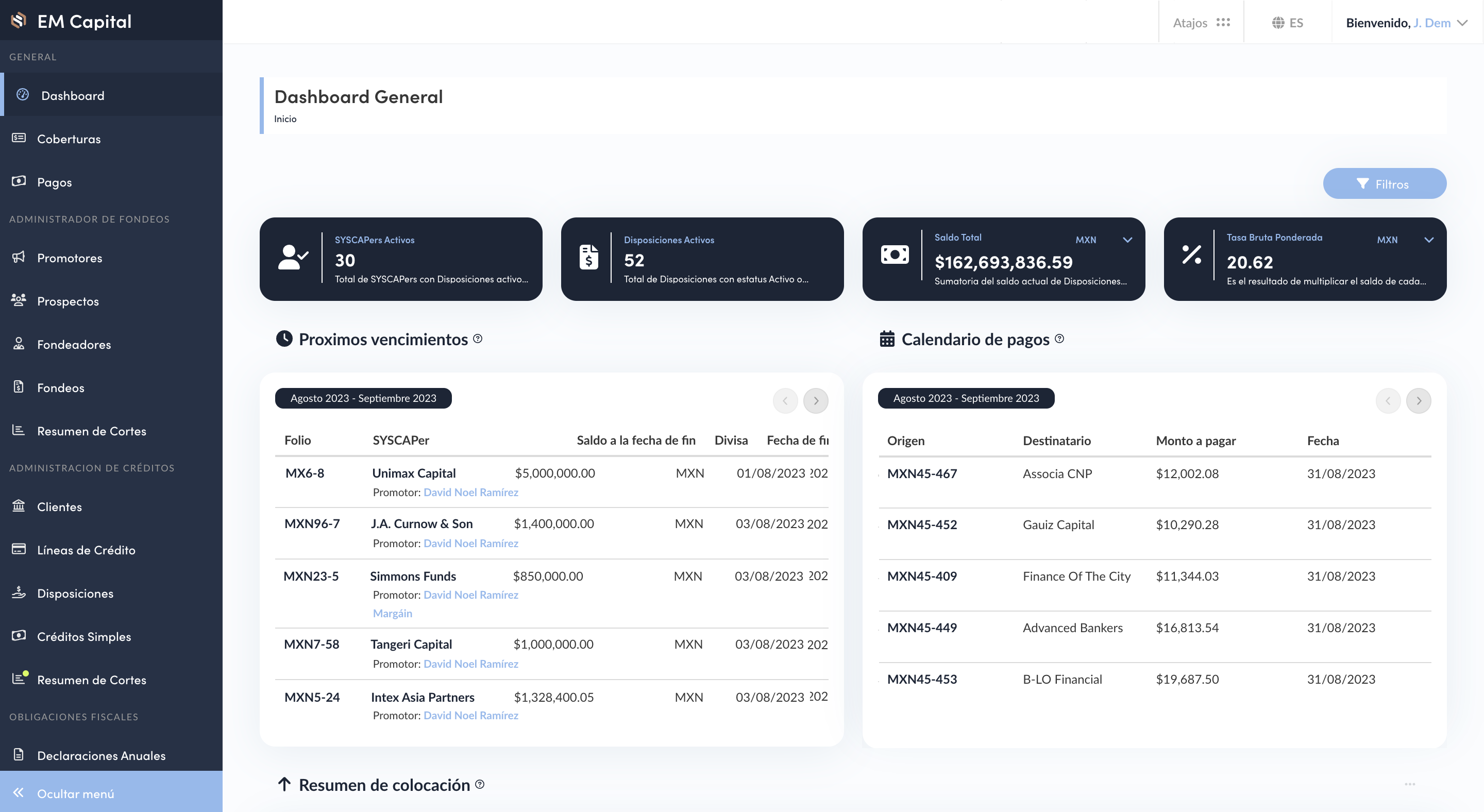

They designed Syscap so that customers can register their private lines of credit and perform communication, monitoring and reporting functions all in one place.

Traditionally, this is either done through banking software and core systems or is done manually via spreadsheets, email threads and unreliable data sources, CEO Ramírez told TechCrunch via email.

However, with the private credit market’s assets under management having nearly tripled between 2011 and 2022, and that growth expected to reach $23.3 trillion by 2027, it presents an opportunity to fill this credit liquidity gap, he said.

As a result, a group of startups has emerged across Latin America in the past year aiming to address the management and transparency of financing lines. Examples of these include Kanastra in Brazil; Finley, Percent and Setpoint in the United States; and Vass in Colombia.

“What sets Syscap apart is our focus on building a holistic and democratized access to private credit platform, not just for non-banking financial institutions but for all stakeholders involved — from lenders and underwriters to borrowers and investors,” Ramírez said.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWSyscap has over 100 non-banking financial institutions across Mexico managing their private credits on its platform. The company also offers access to short-term financing alternatives.

Meanwhile, Wollef led the $2.3 million seed round and was joined by Redwood Ventures, Melek Capital, 500 Global, Angel Hub Ventures and a group of angel investors. With the capital infusion, Syscap intends to invest in technology and product development.

Private lenders won’t fill the venture debt gap left by SVB