Only 7% of founders have a pitch deck with a reasonably good go-to-market (GTM) narrative. Given that a lot of founders are raising money to acquire new customers, allow me to put words to what that means: It’s an absolute embarrassment.

The vast majority of slide decks barely qualify to be called even a coherent brainstorm. As an investor, when I’m looking at such a deck, I despair. Why should I give you $5 million when you clearly haven’t the foggiest clue how you’re going to deploy that money in a meaningful way?

Trust me when I say this: Fundraising is hard right now, and there are no signs that things will get easier. It’s crucial to have a basic level of competency.

Here’s how to approach designing a competent go-to-market slide:

It’s key to develop a deep understanding of your customers for developing an effective go-to-market strategy and persuasive slide. This involves more than just demographic segmentation; it requires immersing yourself in your potential users’ lives to grasp their challenges, needs and decision-making processes. This demands diligence, empathy and strategic market research. Your understanding of your customers often shows up elsewhere in the deck (under “target customer” or similar), but without it, the GTM slide often doesn’t make a lot of sense.

Once you have your data, it’s up to you to distill it and identify patterns in their behaviors, preferences and needs. For instance, if you’re launching a new fitness app, you might find many prefer personalized workout plans. Such insights are crucial for customizing your GTM strategy to your market’s specific needs. That customization, in turn, informs the channels you’ll be using to market your product.

Such info can go in the appendix, but it informs your market segmentation. Since customers differ, various segments may need distinct approaches in your GTM plan. For example, engaging tech-savvy millennials might require a different strategy than reaching baby boomers, even if both groups could benefit from your product.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWPutting all of this together will result in a much stronger go-to-market narrative — one that’s backed by evidence. It’ll also show that you’ve done some experimentation and that you have a baseline you can hopefully improve over time.

Tying the GTM to your cost

The truth is, an innovative product is just the start. Most startup founders over-index on that part. Yes, it’s important, but the real challenge is reaching your target customers. This is where your customer acquisition strategy comes in — how will you attract and bring new users or clients to your product or service? For startups, it’s crucial to engage customers meaningfully to build loyalty. Your GTM plan should outline how to attract, engage, and convert prospects cost-effectively and scalably.

So far, this is all very wishy-washy. The real rubber hits the road when you’re drawing up the plan for execution. What channels will you use? What will it cost? What is your custom acquisition cost (CAC) per channel, and what is your overall CAC per customer across all channels (often referred to as “blended CAC”)? When you have all of those numbers in place, you’ll come across as a founder who has a very clear view of where they are today and where they need to go.

While organic reach is valuable, paid advertising can boost your efforts, especially in the initial days. Platforms like Google and Facebook Ads let you target advertising to reach specific demographics. The key is to create ads that resonate with your target audience, and optimize campaigns for the best return on investment.

From there, your strategy will require ongoing adjustment based on data and feedback. A/B testing different approaches can help identify what works best with your audience. By being open to experimentation, you can refine your strategy for better effectiveness and efficiency — and you can set goals around that. “We acquire customers at $390 right now, but we think we can optimize that to $240 per customer,” is a powerful statement. Back it up with some evidence for your hypothesis, and suddenly you’re telling a very compelling story.

CAC is more than a number; it’s a way to evaluate the effectiveness of your customer acquisition strategy. It should be considered alongside the Lifetime Value (LTV) of a customer, and LTV should significantly exceed CAC for a viable, scalable business model. The CAC-to-LTV ratio is an important metric. Measure it, report it and benchmark it against the industry.

Market expansions

Growth often involves entering new markets or segments. This could mean targeting a new geographic area, addressing a different customer segment, or expanding your product line. Each of these strategies requires thorough market research to identify opportunities and understand the unique challenges they present. For instance, geographic expansion might involve navigating different regulatory environments or cultural nuances.

A clear understanding of these factors is crucial for tailoring your approach to each new market effectively — if part of your GTM is “Launch in Germany” when so far you’ve only operated in the U.S., it’s crucial to show how risky this approach is. Do you have access to the right channels? Do you understand the market? What are the risks of this approach? If your plan works, what is the upside?

It’s universally true that your human capital is crucial for any form of growth, and your team is your most valuable asset for scaling. As you grow, attracting, retaining and developing talent becomes increasingly important. This involves hiring individuals with the right skills and mindset, and fostering a culture that supports innovation, agility and continuous learning. Does your organization have the right people in the right seats to drive and sustain growth? Awesome! Weave that into the narrative, too.

Metrics for the win

So how do you know if what you’re doing is working? You measure it. Metrics are a cornerstone of marketing, and your investors will want to see that your plan is aggressive, but achievable.

Crafting financial projections requires balancing optimism with realism. Estimate your revenue for a future period (monthly, quarterly or yearly) based on market size, pricing, sales efforts and capacity. If you want to go all-out, model it so and include best-case, worst-case and likely scenarios to navigate market conditions in an appendix slide.

For the core deck, though, a firm grasp of your life-time value, the customer acquisition cost, gross margin and monthly or annual recurring revenue (MRR/ARR) helps show that you understand the financial levers driving your growth.

Finding the narrative

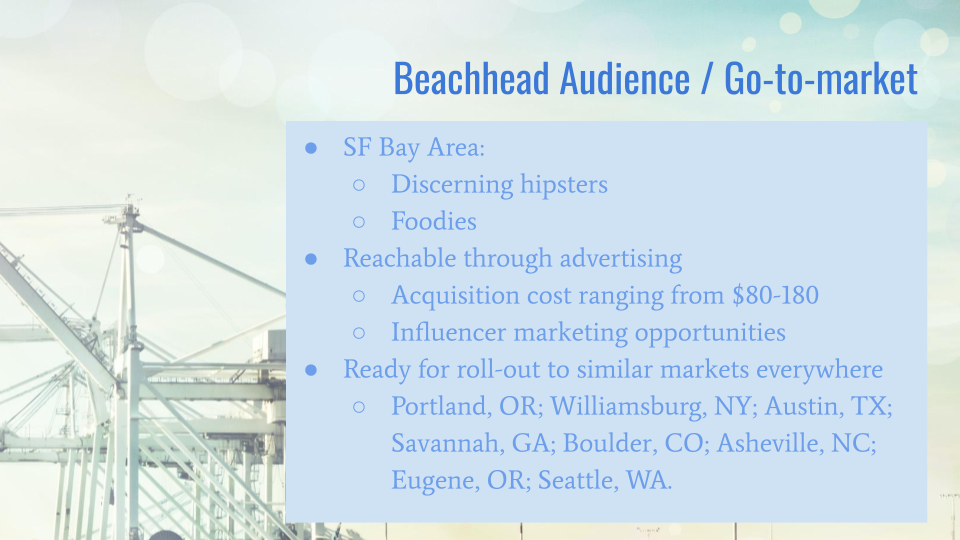

There’s a lot going on in your go-to-market strategy, and you don’t have to tell the full, detailed story in the core deck. Some of the best pitch decks I’ve seen include a strong go-to-market strategy only for the beachhead audience — the first customer profile you are going after. They then include additional approaches in the appendix, but that helps clarify that you have a solid, well-thought-through Plan A for how to acquire customers. All of that together helps an investor justify why they might be interested in writing a check.