The team at DocSend discovered that more and more successful slide decks have something in common: a very good summary slide. In this article, we will look at a bunch of great examples culled from my TechCrunch Pitch Deck Teardown series and detail what needs to go on the slide.

Why you need a summary slide

As a startup founder, your company should be designed to fail as fast as possible. In other words, if what you are building is impossible, find out as quickly as you can so you can get your life back, drink a cocktail or two and attempt to start another business. A summary slide exists, essentially, to help your fundraising journey fail quickly, resulting in your investor deciding not to invest.

I’m calling it “failure” here, but what we are really doing is preventing you or your would-be investor from wasting time: There’s absolutely no point in landing a meeting and talking their heads off for 45 minutes if it turns out that they would never invest because your company is at the wrong stage.

Your summary slide should include enough of the right information that can help an investor tick the box that says, “Yes, this startup fits with our investment thesis.” Specifically, it helps cement your company in time and place by helping investors figure out how much you are raising, what stage your business is in and well, what the hell your company actually does.

As a startup founder, you really need to understand how venture capital works

How do you set the stage?

Your summary slide is probably going to be your first or second slide. Many prefer to let the cover slide be pretty minimalist, but it still needs to do a little bit of the lifting. Personally, I like to think of the first two slides of a pitch deck as setting the stage, and by extension, the first two slides, together, create the context for what’s about to happen.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWIn the first two slides, you’ll want to cover:

- The name and logoof your company.

- A mission or visionfor the company and what you are hoping to accomplish.

- High-level business model— B2B, B2C, B2B2C, dev tools, platform, marketplace, etc.

- A one-line summaryof your business — “Airbnb: A marketplace to help homeowners rent spare rooms to travelers,” or “Twilio: Making SMS messaging easy for developers,” etc.

- General stageof the company — “pre-product,” “pre-revenue,” “pre-product-market fit,” or “growth,” for example.

- Funding stageof the company —”seed round” or “Series B,” and so on and so forth.

- The amountyou are targeting to raise — i.e., raising a $4 million round.

- The industryyou are in — medtech, proptech, fintech, blockchain, smart home, etc.

- Founding date — if relevant, it can help signal how long you’ve been working on this problem.

- Any major milestonesyou’ve accomplished recently, ideally in the form of traction metrics.

Remember that the goal isn’t to go into a huge amount of detail on each of these things. Your “ask” and “use of fund” slides will say more about how much you are raising and what for. Your business model can come out to play later in the process. Your industry and milestones and traction will get discussed in other parts of the slide deck. The goal with the first couple of slides is to level-set and ensure everyone has the context they need. Keep it as crisp as you can.

Some example summary slides

- Good: Arkive creates a super clear picture of what its mission is on this slide.

- Could be better: A mission statement alone isn’t enough of a summary.

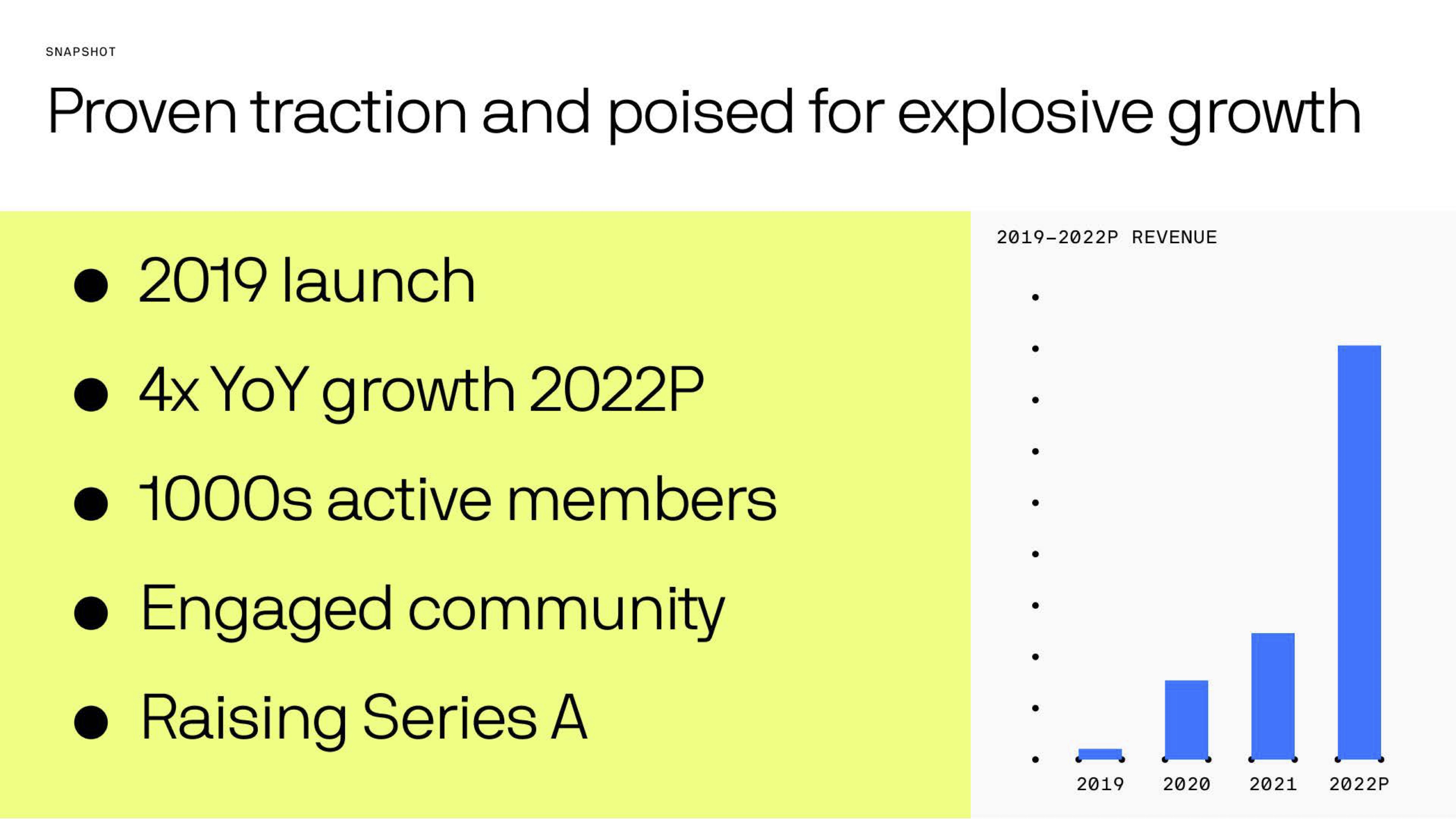

- Good: Includes revenue graphs, major metrics, and shows the company stage (thousands of active members) and round (Series A). The company also includes “Optimizing health with precision nutrition” and “Series A” on its cover slide, which works great.

- Could be better: It could say more about what it does and who it does it for. Be careful when using projected numbers in summaries, unless you’re reallycertain you’ll hit those numbers.

- Good: Includes important key metrics (founding date, number of characters and videos produced). The cover slide also includes a mission statement: “Bringing the Human to the Virtual.”

- Could be better: I might have included more about how much the company is raising now and a clearer idea of what its mission is. It would also have been useful to make explicit what it does: “AI-powered, character-based video generation for businesses.”

- Good: Great and clear mission statement. The cover slide just says “Series B.”

- Could be better: Doesn’t say much about what it does or how far it has come.

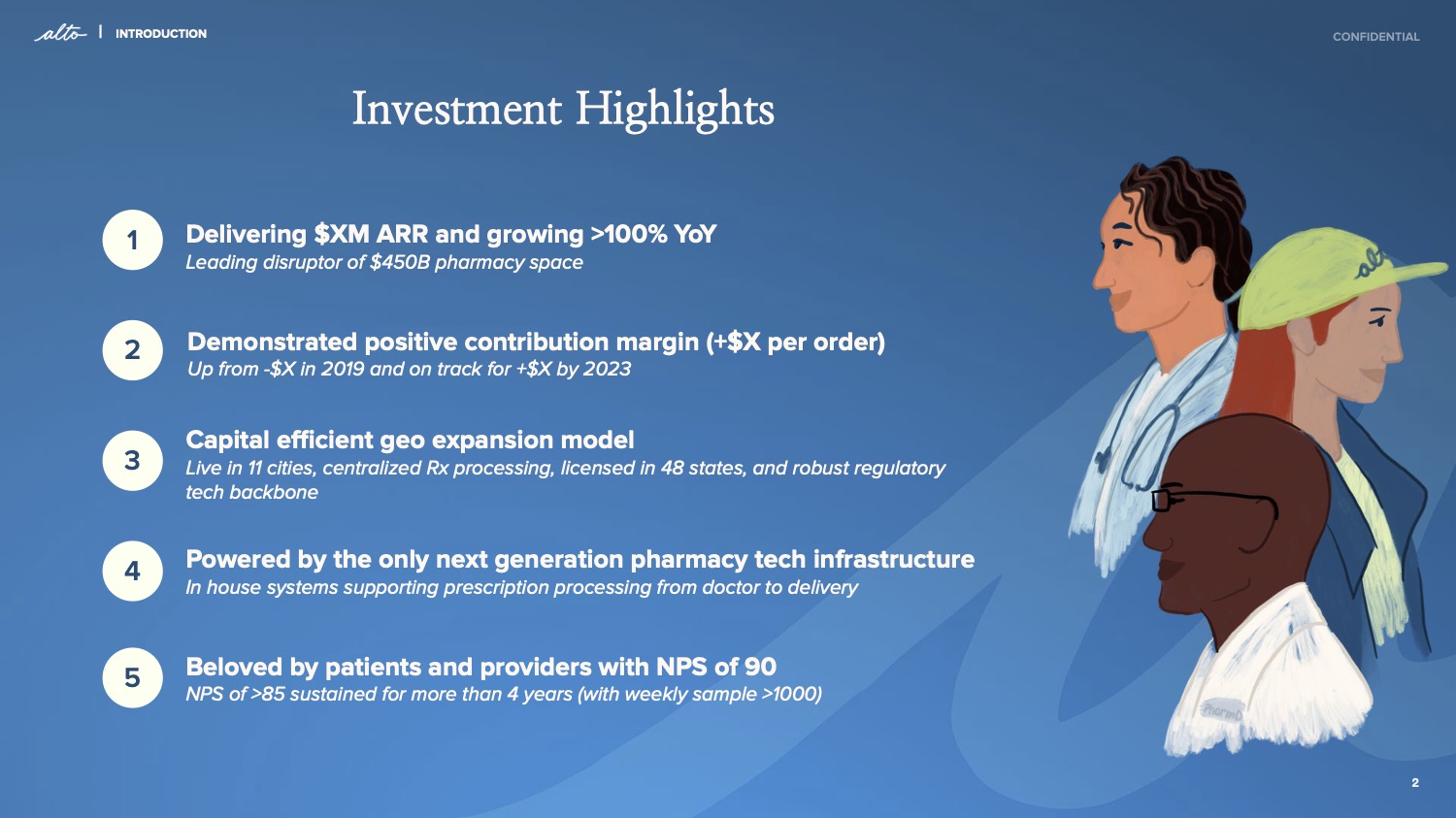

- Good: Alto’s cover slide reads, “Finally, a pharmacy that over-delivers,” which really helps set the tone. It then goes into this slide, which uses a ton of metrics to show why it makes a good investment. Very well done.

- Could be better: Doesn’t name how much it is raising or its mission and where it is going.

An example that works

As you can see from the examples from actual pitch decks above, there are few examples of companies that actually do the summary slide well — hence this article, I suppose.

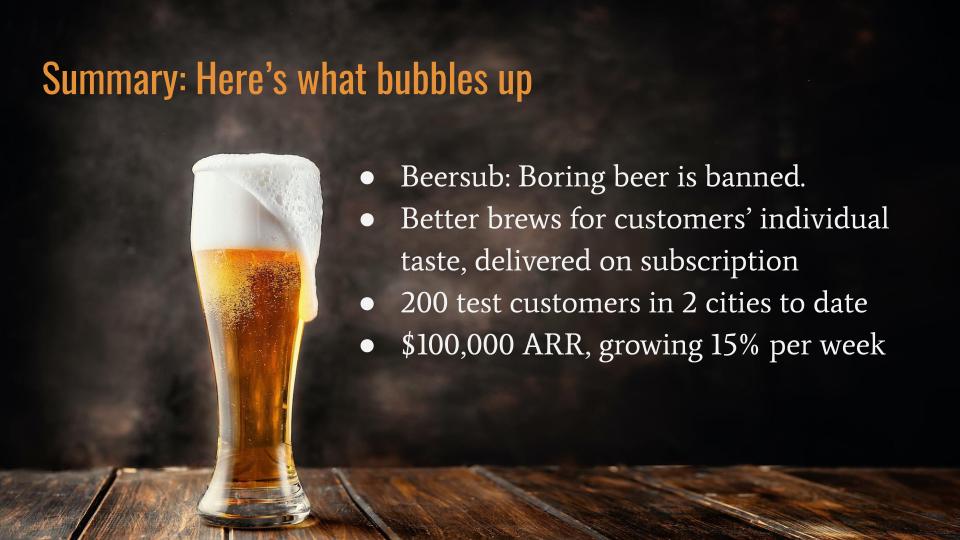

You may have seen BeerSub before; it’s the fictional company I created in my book, “Pitch Perfect.” There’s also a pretty decent template you can use, along with a bunch of notes for what to focus on for each slide.

- Good: “Netflix for Beer” is hokey, but helps convey that it’s a B2C play with a consumer brand. “AI-powered” hints at the technologies at play, and the word “subscription” tips off investors that this is a subscription business model. “Raising $2.5m” suggests that this is a pre-seed investment, and “launch in three strategic markets” sets the pace.

- Could be better: Light on vision, and “Launching in 3 markets” doesn’t really say anything about whether there’s a product in the market, or how many customers are already using it. That would be helpful; from this slide, it seems like it would be possible that this is a very successful company already active in one or two markets. If that’s the case, that is a pretty different company from a pre-launch, pre-product, pre-revenue company.

So, how do we augment the cover slide? With a summary slide that ticks the rest of the boxes:

By adding a summary slide to round out the information available on BeerSub’s cover slide, we cover all the bases from the checklist above. Between these two slides, it includes everything we need for the summary:

- The name and logoof the company, BeerSub, although, obviously, the “logo” is awful.

- A mission or vision:“Boring beer is banned.”

- High-level business model— B2C subscription business model.

- One-line summary— “Better brews for customers’ individual taste, delivered on subscription.”

- General stageof the company: It has test customers and some revenue.

- Funding stageof the company. This doesn’t explicitly name the round, but it does show the amount, which suggests a pre-seed round, probably the first institutional round. For perfect marks, I’d have made that explicit here, but I suspect investors will be able to connect those dots.

- The amount— $2.5 million.

- The industryyou are in — food and beverage, specifically beer subscription.

- The founding dateis omitted here; it might have been helpful to figure out how long it took to get those 200 customers.

- Major milestones: 15% weekly growth is impressive, and $100,000 annual recurring revenue isn’t going to wow anybody, but it is better than many early-stage companies.

In summary

It can feel like you are cramming a lot of information into the first two slides of a deck, but that’s OK. It’s helpful to level-set what your investors are about to look at. Things that are important for growth-stage companies are less important for earlier-stage companies. Ensuring that everyone is on the same page makes the storytelling as part of your pitch far easier.