Yes, reading the tech press in the last week has been pretty brutal. And yes, you and your startup may still be rattled by the Silicon Valley Bank crisis or worried about what’s going on at First Republic. Hell, you could still be working to secure your funds somewhere new.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The cliche about rain quantity during downpours exists because bad news tends to pile up when it arrives. That SVB imploded while startups were already struggling in the face of a sharply more conservative fundraising environment, a completely denuded IPO forecast and antitrust making M&A a tough sell is therefore not surprising, even if a financial crisis felt like an unfair piling on.

But the news is not all bad. Amid the chaos, there are rays of good news. They include surprisingly good results from a pair of software companies’ earnings reports and a bounce off recent lows for software valuations.

Ready for a break in the deluge? Let’s find a smile.

Ready for a break in the deluge? Let’s find a smile.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWPositive vibes

Kicking off our good-news fest: UiPath. Shares of the RPA giant are up over 17% in morning trading. That’s a lot for a company worth billions of dollars.

Why is UiPath soaring? Its earnings results crushed expectations (data via Google Finance):

- Revenue: $308.5 million reported, $278.7 million expected.

- Earnings per share (adjusted): $0.15 reported, $0.07 expected.

The company added nearly $94 million in net new ARR along with operating cash flow of $94.0 million. Investors lapped up the results.

Something interesting about UiPath’s results, however, is that its current-quarter forecast is actually under street expectations. And yet it is still rallying. Perhaps investors simply believe that UiPath is sandbagging a bit on its current quarter’s results. We’ll see, but the stock is up and the trailing results were good. That’s a win in 2023.

Next up? PagerDuty. Much like UiPath, it posted a top and bottom line beat (data via Google Finance):

- Revenue: $101.0 million reported, $99.0 million expected.

- Earnings per share (adjusted): $0.08 per share, $0.02 expected.

As with UiPath, PagerDuty had solid operating cash flow to bolster its headline results. In its most recent fiscal quarter, the software entity reported $17.6 million worth of positive operating cash flow, up from $1.3 million in the year-ago period. That rules.

Shares of PagerDuty are up nearly 17% in trading so far today. This is doubly impressive when we recall that many software companies that reported in recent weeks have not enjoyed any share-price appreciation post-earnings at all.

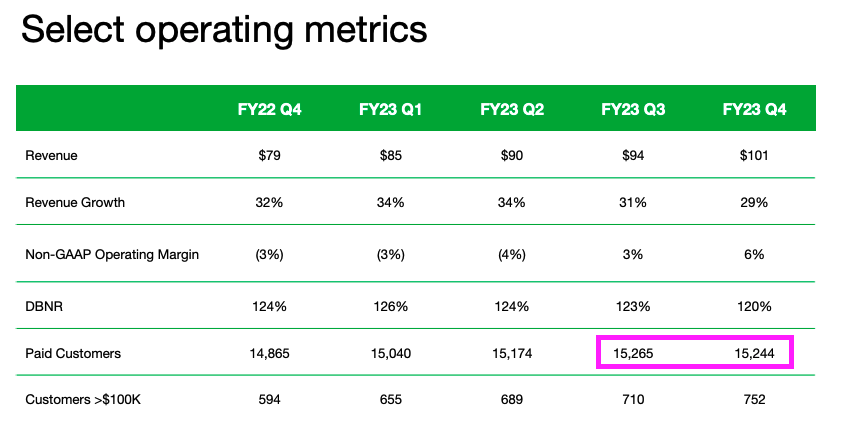

One final note on PagerDuty, however, and I hate to bring a darker cloud into our attempt at a sunny day, but observe:

The company reported a declinein total customer count. Sure, the number of customers it had that were worth more than $100,000 in revenue went up, but it’s a sign of the times that PagerDuty actually churned more logos than it earned in the period. That’s the state of today’s market; everyone is looking to trim costs, and here we can see a bit of that trend represented in numerical terms.

The other good news

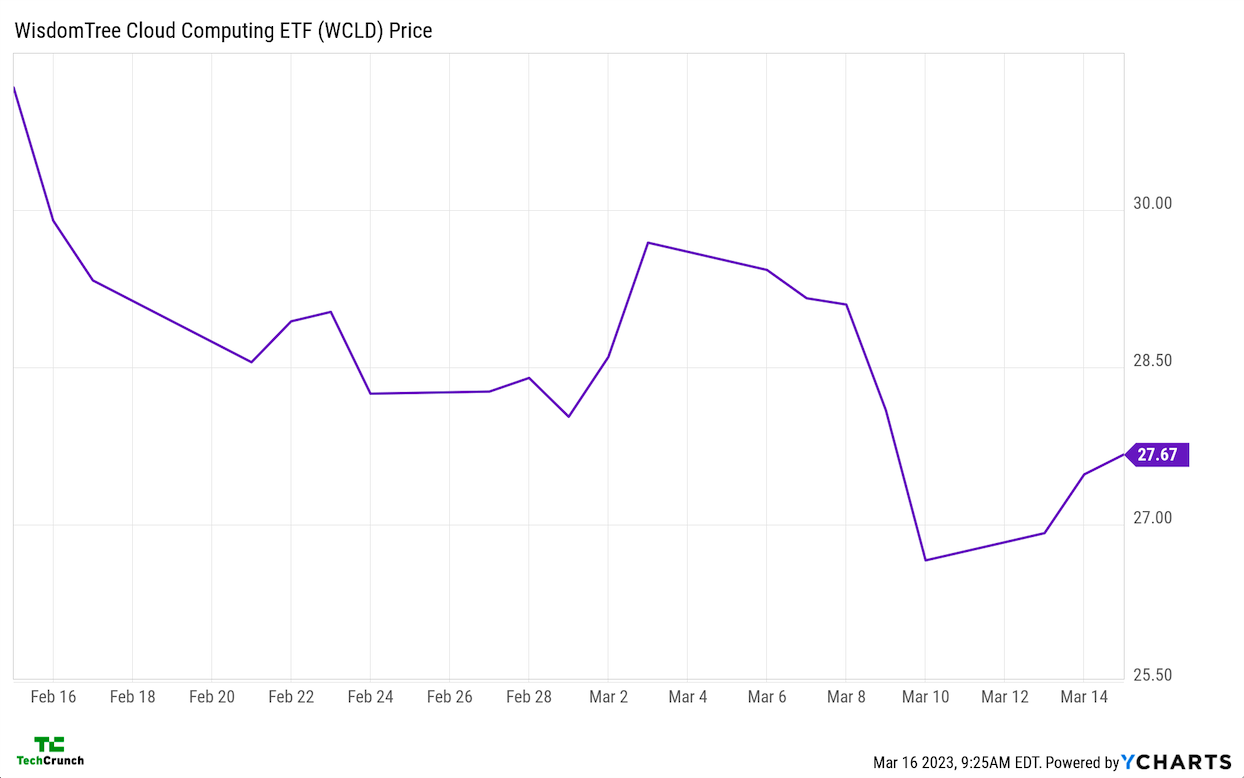

Earlier in March, TechCrunch+ noted that “valuation pressure on software startups is easing” after a lengthy period of decline. Well, after we wrote that, SVB fell apart and stocks sold off. The goodnews is that if we observe a chart of the Bessemer Cloud Index, we seem to have reached the bottom and begun to bounce. Here’s the zoomed-in view:

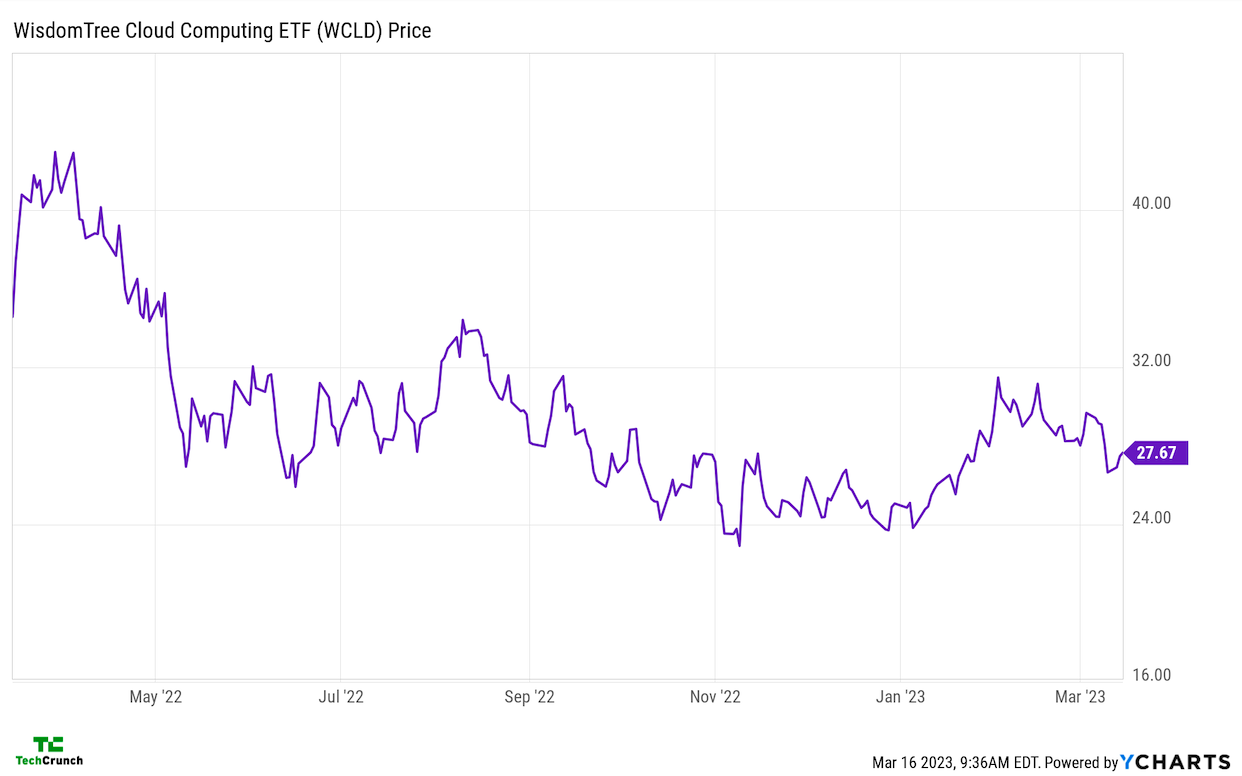

The same collection of cloud stocks set lows in late 2022 and early 2023 before recovering through February. Here’s a longer-term chart of the same collection of stocks:

Recent declines in the wake of all the bad news took some shine off that rally, but with the index up again, we are seeing critically important public companies for startup valuations recover after the latest shock. That’s very good.

And welcome, I suspect, for startups still adjusting to new market norms when it comes to the value of software revenues. The last thing that startups need right now is for yet more weight to be added to their shoulders.