Small businesses in Latin America got another boost in lending support with the investment of $4 million in Kala, a Colombia-based company building fintech infrastructure for lending.

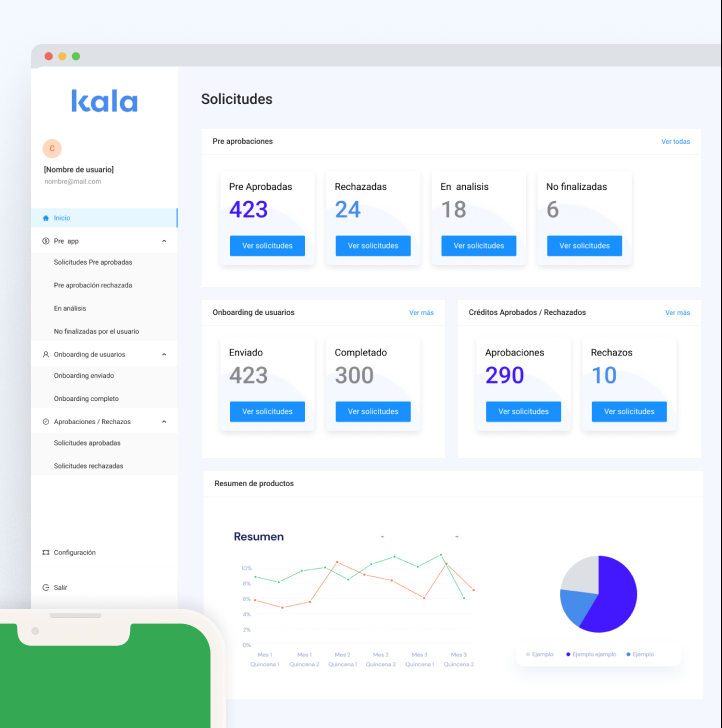

The company, co-founded by Manuel Alemán, Rodolfo Lazo and Pablo Cattólica in 2022, is developing a vertical SaaS product for institutions, like banks and credit unions, that want to launch and operate their own credit products.

Alemán, who has a background in microfinance, explained that lack of inclusion and access to capital in Latin America account for low loan penetration figures, in the low double digits in many cases.

“We turn any lender into a fintech lender,” Alemán told TechCrunch. “Our goal is to increase financial inclusion in Latin America and empower small banks and credit unions to serve the underserved markets.”

Kala officially launched in July 2022 and within the first six months had three customers, two in Colombia and one in Mexico, using the product and dispersing it to over 50,000 customers. Kala charges a SaaS fee and is already bringing in revenue, Alemán said.

Now flush with capital, the company joins other fintechs — for example, Kredito, Mono and Marco Financial — providing avenues for businesses to get access to credit.

The new funding, which closed in December, brings the company’s total funding to $6 million. It was led by Cometa and included existing investors Canary, Acrew, Clocktower and 99 Startups.

Techcrunch eventJoin 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

Join 10k+ tech and VC leaders for growth and connections at Disrupt 2025

Netflix, Box, a16z, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just some of the 250+ heavy hitters leading 200+ sessions designed to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch, and a chance to learn from the top voices in tech. Grab your ticket before Sept 26 to save up to $668.

San Francisco | October 27-29, 2025 REGISTER NOWThe company currently has 28 employees and will deploy the capital into expansion of its product, tech, customer acquisition and customer support teams. Kala will also continue to focus on Colombia and Mexico this year.

“It’s a perfect time for Kala because banks understand how difficult it is to get a credit product started,” Alemán said. “We can do this in weeks, not years, and we aim to become the standard for fintech lending in Latin America.”

If you have a juicy tip or lead about happenings in the venture world, you can reach Christine Hall at chall.techcrunch@gmail.com or Signal at 832-862-1051.Anonymity requests will be respected.

Taking advantage of Latin America’s market downturn